To provide you with an accurate and tailored quote for our services, we first need to review the state of your current accounting software and financial reports. This information will be held in confidence, only being viewed by select members of our onboarding team and will not be shared with anyone outside of our organization.

How to Request a Quote #

Requesting a quote is quick and easy and can be done through our website using the link above. You will be asked to provide specific information about your business, some of which may be sensitive and/or confidential. Not to worry—our proposal request form is fully encrypted with end-to-end security, so you can be confident that the information you share is safe. This information will only be viewed by select members of our onboarding team and will not be shared with anyone outside of our organization.

What to have Prepared #

Come prepared with access to your accounting software and identifying business information

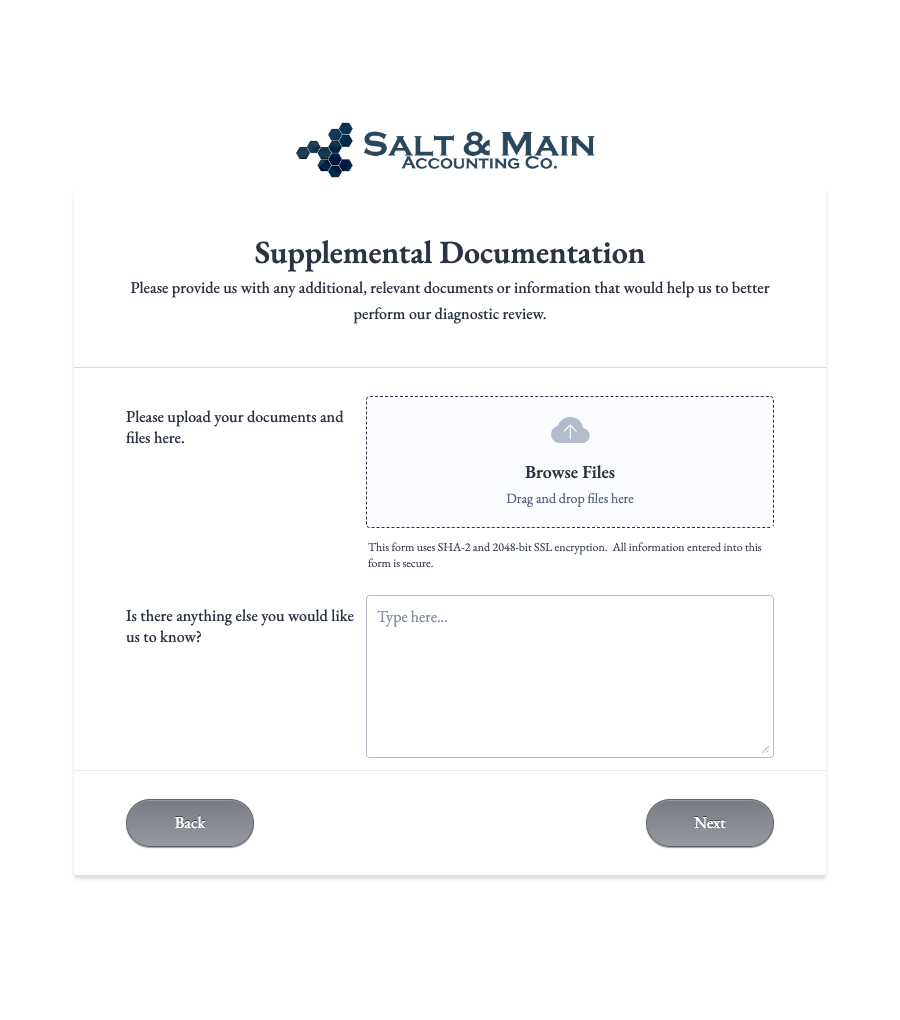

Be sure to have access to your financial reports, bank statements, general ledger, and any documentation you deem relevant in helping us familiarize ourselves with your company and financial history. A few key items to have on hand that you will be asked to provide are:

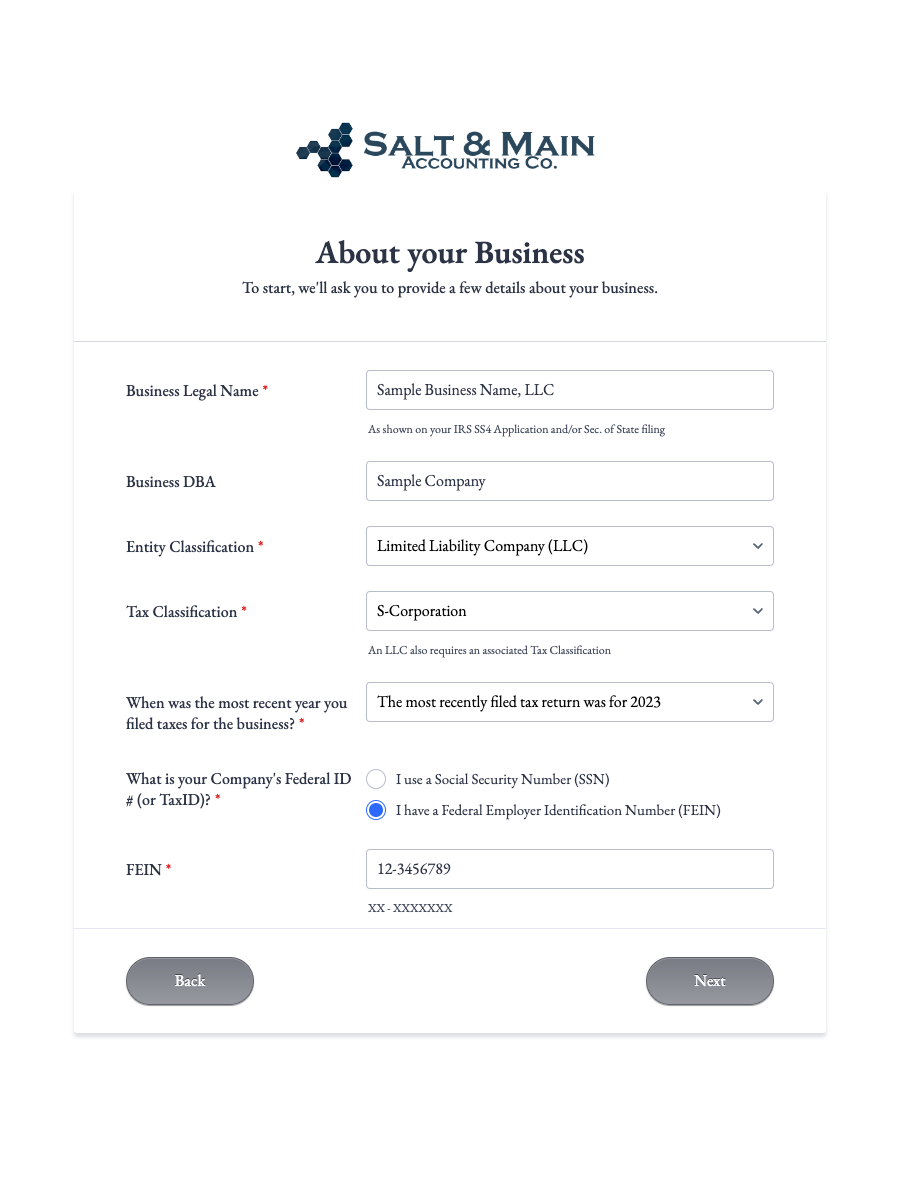

- Your EIN and entity classification (sole-prop, partnership, S-Corp, trust, etc.)

- Date of the most recently filed tax return

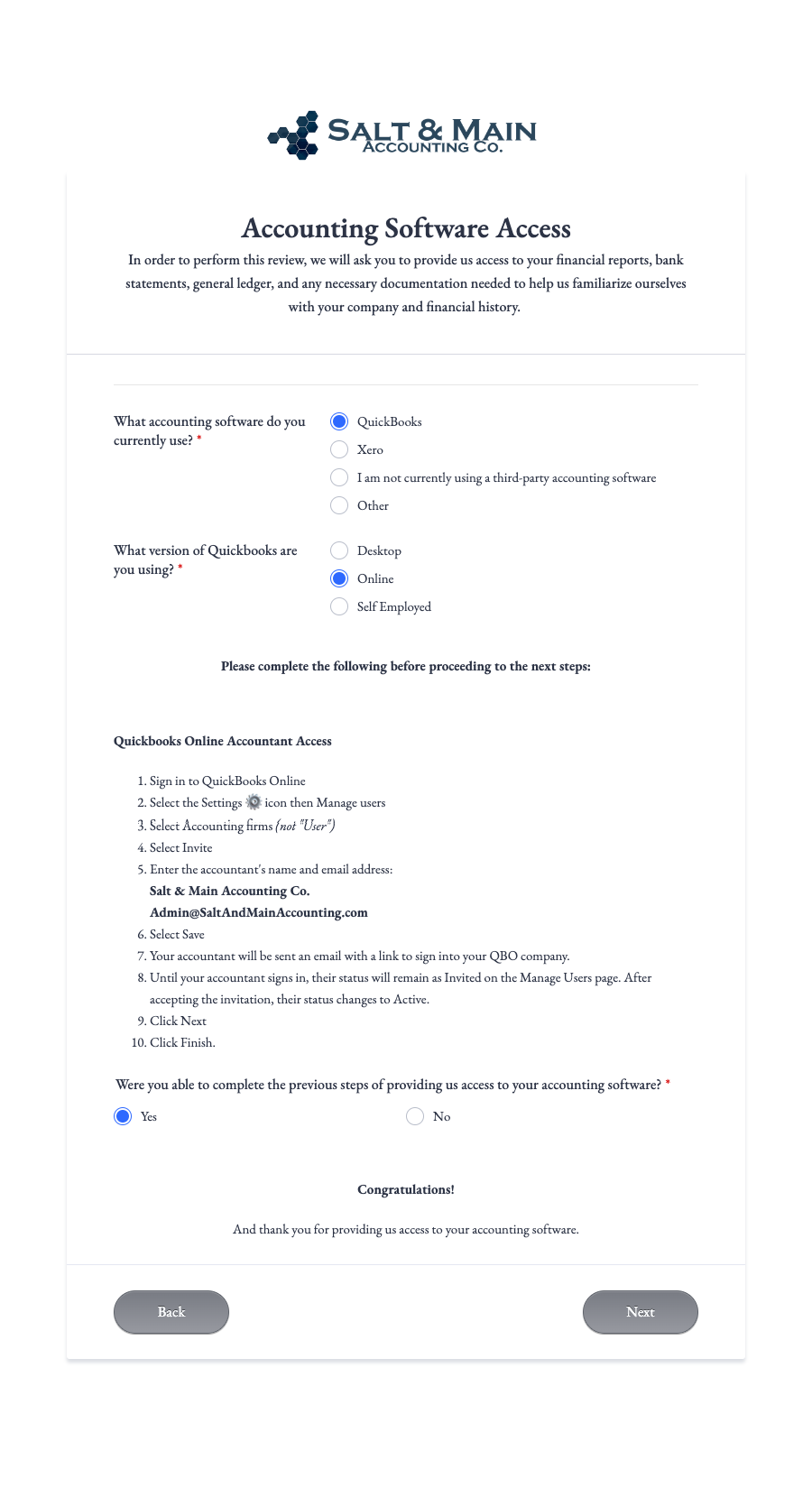

- Admin access to your accounting software (Quickbooks, Xero, or other)

Filling out the Form #

Plan for about 15 minutes to answer a few questions and upload documentation

First, you will be asked a few simple questions about your business:

follow up by instructions for how to provide Salt & Main with access to your accounting software:

or if you don’t use an accounting software, you can upload statements, excel files, receipts, etc. on the next page:

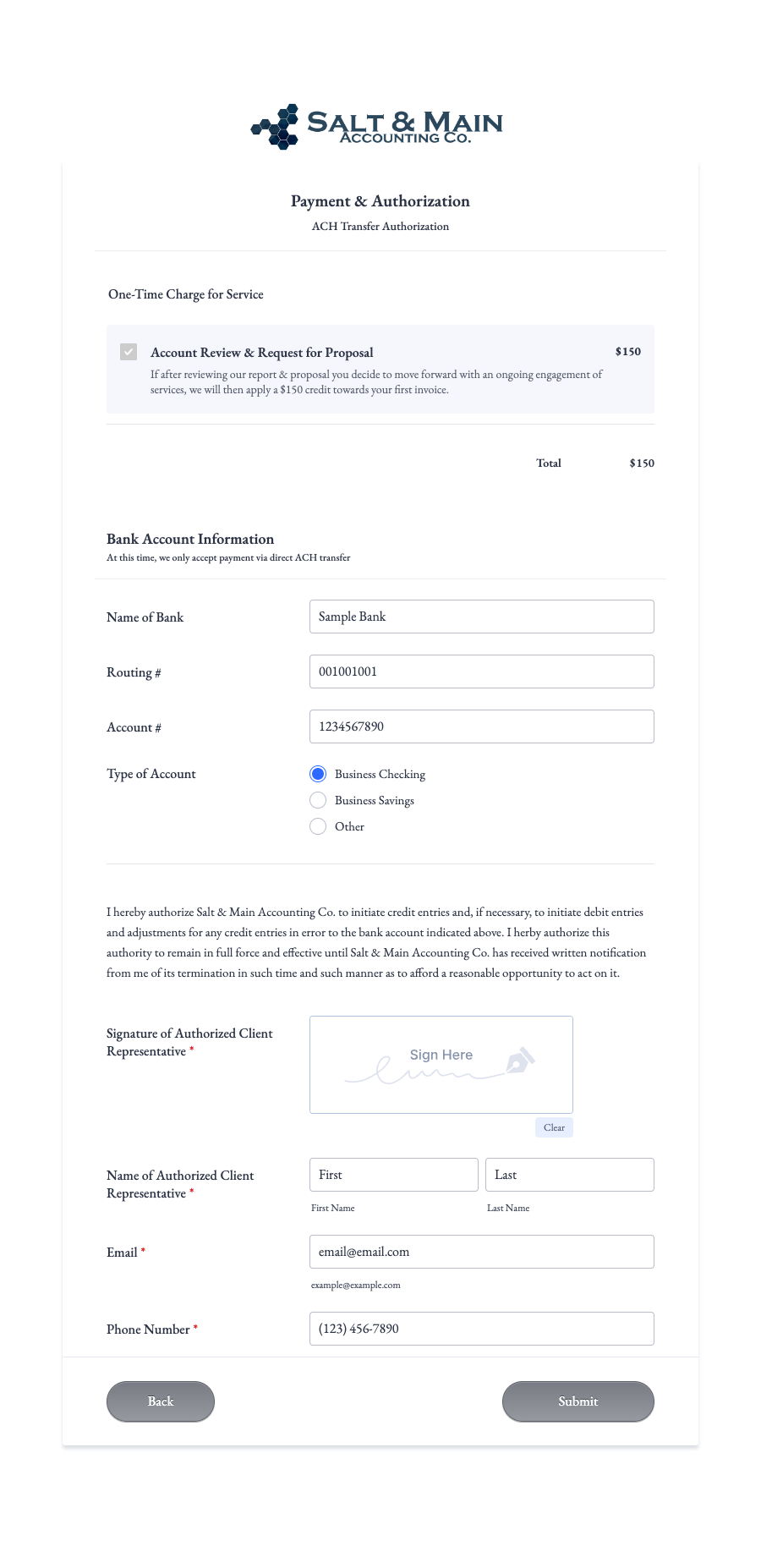

At the end, you will be asked to fill out an ACH agreement for a one-time charge for us to review your accounts and prepare a proposal for review:

If after reviewing our proposal, you decide to move forward and sign an ongoing monthly engagement agreement, we will apply a $150 credit towards your first invoice.

Follow Up #

Expect a follow-up email from a member of our onboarding team shortly

Our team will diligently review your accounts and financial reports to prepare a tailored proposal of services for you. Once the proposal is ready, we will contact you to schedule a follow-up meeting to review it together, answer any questions you may have, and provide an exact price quote.